Education Savings Solution

White Investments’ Education Saving Solution is our answer to a significant dilemma facing most parents in South Africa today:

“How do we afford the ever increasing costs of providing our children with the best education that we can?”

A blog article we wrote on the cost of education got widespread interest from thousands of parents, illustrating just how big an issue or priority this is in most parents minds. The comments on social media showed that there are different views about what constitutes a good education, with much of the focus on the value of a private education relative to the costs thereof.

Regardless of the opinions expressed, it was evident that all parents really want, is to give their kids the best start in life that they can. Whether that is a private school education or a financial foot-up for a business or apartment after school, an investment plan will go a very long way in helping to achieve that.

To find out more you can take a look at the following Q&A we have compiled to help answer some of the more frequent questions relating to this offering:

This is an investment solution that White Investments has developed specifically to assist parents/guardians/grand-parents to cope with the ever increasing costs of education in South Africa.

It is single-mindedly focused on helping you provide for your child’s education.

It is designed to provide peace of mind that your children’s education requirements can be met by delivering insight into the costs of education and identifying how to meet the challenge of giving your children the best options for their education.

Anyone with children will know that providing the education you want for your kids is becoming a far greater financial burden than ever before.

Whether it is a genuine decline in the quality of education in South Africa or an irrational fear that is pushing up demand for private or semi-private education, the fact remains that the cost of educating our children is on the up.

If you want to be pro-active in providing for your children’s education needs then having a plan of action is a great idea. Our Education Savings Solution is designed to provide you with a just such an action plan for reaching this important financial goal.

While you will need to sign up for this service on behalf of your minor child, you should seriously consider roping in the help of your friends relatives and even work colleagues to “crowd-fund” your children’s education. Instead of receiving a plethora of toys and non-essentials, perhaps Birthdays and Christmas’ could be treated as an opportunity for everyone to make a small contribution to future education fees. All these amounts will add up and could be very meaningful indeed over a period of 14 years or longer.

Unfortunately our best intentions are frequently not enough to get us over the finish line when it comes to achieving some of our life goals. There are all sorts of distractions and temptations that lead us to lose focus of our main priorities from time to time.

By implementing our Education Savings Solution you can set up a savings and investment strategy that prioritises saving for your child’s education and requires little month-to-month involvement or activity.

Committing the funds either in lump-sum form upfront or as an ongoing debit order contribution, will help improve your savings discipline and stop this money from being seen as a part of your disposable income.

Planning for your child’s education, from as young an age as possible, will give you peace of mind by easing the financial burden in the years ahead.

It will provide you with options for the choice of education institution and allow you to tackle this challenge from a position of knowledge and strength.

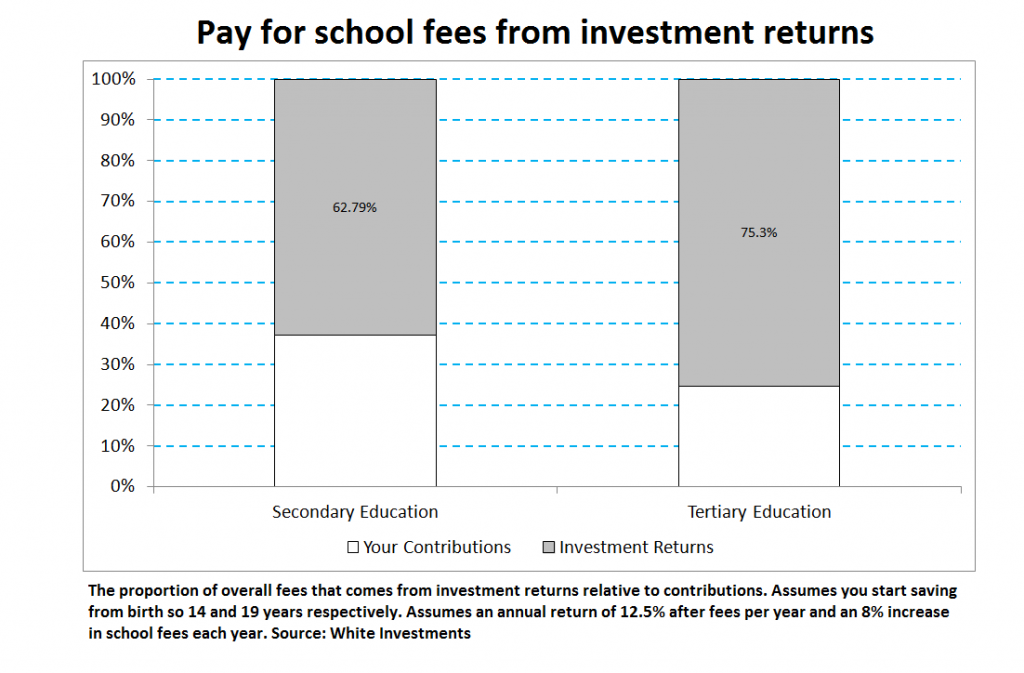

If you are able to start saving for your child’s education (via monthly contributions) from birth, up to 63% of your child’s high school education fees could come from investment returns rather than out of your own income.

For tertiary education this figure could be as high as 75%.

If you have some spare cash lying around or grandparents with a desire to contribute towards education via an upfront lump-sum contribution, this figure could be as high as 80% for secondary education and a whopping 89% of tertiary costs.

*Assumes a full allocation to equity for 14 years earning a historically reasonable 12.5% per year after fees.

It translates your education choices into coherent financial objectives.

It determines the estimated future cost for your preferred school(s).

It calculates the savings contributions you will need to make to achieve your target

It proposes an investment strategy to meet your specific goals.

It uses cost efficient fund and investment platforms to deliver the appropriate returns, ensuring that more of your hard earned money goes towards providing the education you want.

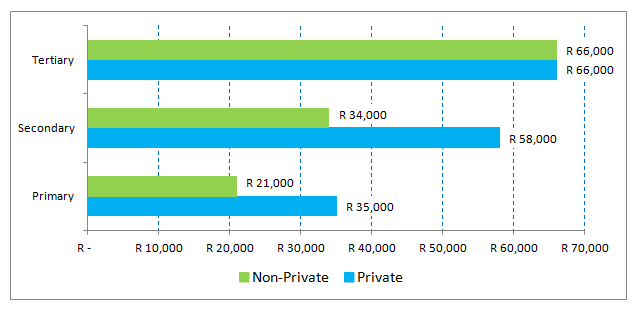

The cost of education differs widely depending upon your school of choice. The top private high schools in the country can cost as high as R277,000 per year (Boarding and Tuition), while at some very reputable non-private schools, you are looking at around R117,000 for tuition and boarding (2018).

As an indication the following figures approximate the cost differentials between private and non-private fees at the various levels of education.

Should you sign up for our solution and you nominate the specific school you would like to target, we will base our calculations and strategy for that specific school.

Typically speaking school fees have been rising at a faster rate than inflation (as measured by the CPI or Consumer Price Index). Most institutions factor in a fee hike of 7.5% to 10% per year.

What does that mean in rand terms?

The parents of a child born in 2018, who want to send him/her to a high school with a current tuition fee of R34,000, will have to fork out R99,865 in 14 years time.

This assumes costs go up by 8% a year.

The earlier you start the better. The longer your investment time horizon the greater the amount of risk you can absorb to achieve higher returns and the longer you have to let compounding work its magic.

As an illustration you can see the impact on the contribution you need to make on a monthly basis if you start saving from birth against starting from the age of five years old.

Once again this depends on the age of your child and the costs of the school or institution that you want to send your child to.

The younger you start saving, the lower the contribution rate required.

Of course the more expensive the school you are planning on targeting for your child, the larger the required contribution.

Our model will specifically outline the contributions required to meet your targeted institution.

However, we do give you the option of specifying a contribution rate that you feel more comfortable with, at the application stage. We will then provide you with a comparison between this preferred rate and what we would consider the “required rate” given reasonable market return assumptions.

You provide us with information on your child’s date of birth, the levels of education you want incorporated into the plan (primary, secondary and tertiary) and the institutions you would like to target.

We input this data into our proprietary model, the outputs of which include the estimated cost of those education institutions by the time your child reaches the relevant school going age, the contributions you will need to make given a set of assumptions on market returns and the inflationary costs of education.

We then use these outputs to propose an investment strategy to meet your specific targets.

We target having the full cost of education available by the start of the respective education phase. This means that if we calculate future Secondary School (High School) fees to total R500,000 then the model will provide a savings & investment strategy that will aim to have that full amount (R500,000) available at the start of the Grade 8 school year.

IMPORTANT: This is not a guaranteed investment product. Your strategy is likely to incorporate exposure to equity markets and listed property investments which fluctuate in value over time. As with all forms of investment planning, you will need to monitor and potentially adjust your plan during the life of the investment.

The Investment Proposal Document (IPD) is how we will deliver our service to you. It is the written account of the solution we have put together based on the information you have supplied at the application stage.

It will provide comprehensive details on investment objectives, investment strategy to follow, risks, full transparency on fees and costs at all levels and recommendations on which funds and platforms to use to execute your solution.

The IPD will serve as the formal record of advice between you and White Investments. Whether you have us manage the solution for you on an ongoing basis or consult with us from time to time at our hourly advice rate, this document will allow us to keep record of the orginal plan and any adjustments we may have made from time to time.

Please read this Investment Proposal Document fully and make sure you understand all aspects of your plan. If you are in any doubt about the contents of this solution then please feel free to contact us for clarity. We provide solutions that are designed to meet your objectives and require that you are comfortable and committed to the strategy.

We are committed to being fully transparent on all fees involved in delivering a service that makes a difference. In order to lower the cost to our clients we have standardised certain services (Including the Education Savings Solution). We are able to do this because the workload involved is similar in nature and this allows us to provide the service in a streamlined manner without unnecessary costs of meetings or excessive individual analysis.

The Education Savings Solution standard flat advice fee per child is currently R5,500 (5 hours – 2021). This fee is a flat fee regardless of whether your plan incorporates all three levels of education or just a single objective.

However, if you would like to plan for multiple children simultaneously and with the same education institutions please contact us so we can arrange a discount.

This fee includes all work that White Investments conducts to provide you with the initial Investment Proposal Document (IPD).

This fee excludes ongoing administrative platform fees, or underlying fund management fees which you will pay to the service providers we use to implement your strategy. All fees will be highlighted in the Investment Proposal Document (IPD) and full transparency is ensured.

White Investments will help with the initial implementation of the strategy if it is done within a period of 3-months from the date of issuance of the IPD, otherwise a further consultation may be necessary to adjust the figures and update the inputs accordingly.

The initial advice fee covers the work involved in providing you with a strategy and does not include the ongoing monitoring or management of the investment. It is your responsibility to ensure that you make the necessary funds available and monitor the progress of the investment over time. A successful plan will take patience and discipline and White Investments will remain available to consult with at the relevant hourly rate.

If you would prefer to have your plan managed by White Investments on an ongoing basis we will levy an ongoing annual fee calculated as a percentage of assets under management (1% ex VAT) in addition to the stated advice fee.

Start the process by completing the following APPLICATION FORM in full and returning it along with the relevant FICA documentation to info@whiteinvestments.co.za

By signing the forms you confirm that you accept the initial advice fee and that you would like to go ahead with the service.

We will follow up with you to confirm the information we have received, clarify any outstanding issues and give you an indication of when you can expect your Investment Proposal Document (IPD).

Please contact us if you still have any outstanding queries or visit our homepage if you would like to find out more about White Investments.